Credit Score to Buy A House: Best to Minimum Score Needed

Apr 23, 2024 · A FICO score is a single number that’s calculated using a proprietary formula and data compiled by the three major credit reporting bureaus (Experian, Equifax and TransUnion). FICO credit scores can range from 300-850. According to Experian, most consumers have credit scores that fall between 600 and 750. What’s included in a mortgage FICO ...

How Your Credit Score Is Calculated - Zillow

Oct 10, 2023 · Some credit card companies and banks already include your score on monthly statements or make it available online. You also can purchase your credit score from one of the credit bureaus or FICO.If your score seems low, you can request a free annual copy of your credit report from each bureau at AnnualCreditReport.com or by calling 877-322-8228 ...

How Do Co-Borrowers’ Credit Scores Affect a Home Purchase?

Jan 22, 2018 · Thinking of buying a home with a partner? Understand which credit scores lenders use most, and the difference between a FICO score and credit report. Buying a home with a co-borrower means the interest rate of the joint mortgage loan is based on the borrower with the lowest score, but both incomes are considered.

4852 W 118th St APT 2, Hawthorne, CA 90250 - Zillow

4852 W 118th St APT 2, Hawthorne, CA 90250 is currently not for sale. The -- sqft apartment home is a 1 bed, 1 bath property. This home was built in null and last sold on 2024-10-18 for $1,750.

Earn A Higher Credit Score ASAP - 8 Steps to Increase Credit Score …

Sep 1, 2022 · There are two different credit scoring models that can be used: a FICO score and a Vantage score. What’s the difference between a FICO score and a Vantage score? Your Vantage score is the score you’re likely familiar with; it’s commonly reflected on credit monitoring sites or apps. But a FICO score calculates your credit using an industry ...

How Paying Rent Can Help or Hurt Your Credit Score | Zillow

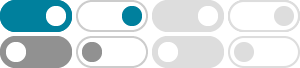

Jan 17, 2024 · Here’s a breakdown of FICO’s scoring model: Poor credit = score of less than 580. Fair credit = score of 580-669. Good credit = score of 670-739. Very good credit = score of 740-799. Exemplary credit = scores of 800+ The scores can change frequently as the information collected changes. What credit score do I need to rent a home?

1741 Park Ave - 1741 Park Ave Long Beach CA - Zillow

To schedule a viewing, contact the community manager Brian. Don't miss out on this opportunity to call this apartment your new home! RENTAL CRITERIA: 650+ FICO score 2.5X income vs. rent No evictions on record If you are approved to be one of our tenants, there is a mandatory "Tenant Resident's Package" of $40 to be paid monthly.

Down Payment Calculator: How Much Should You Put Down?

For example, FHA loans allow for a down payment as low as 3.5% with a minimum credit score between 500 and 580. Conventional loans typically have stricter requirements (with a minimum credit score between 620 to 660) and may offer better rates with higher credit scores.

Can You Buy a House With No Credit? - Zillow

Oct 7, 2024 · Buying a house with no credit is possible if you’re using cash to make your purchase. If you plan to buy a house with a mortgage, however, you’ll typically need a credit score and an established credit history to be approved for a loan. Your score informs lenders of the likelihood that you’ll repay the loan and dictates your interest rate.

Avana Bayview - 1631 S Federal Hwy Pompano Beach FL - Zillow

Lessee, DEBRA FELDMAN (Bay Yacht Club, 740 S Federal Highway PH-604, Pompano Beach….10 year) has sterling credit and the highest FICO Score; 2. She wants to rent an apartment for her elderly father STEPHEN GALAT who has lived abroad for many years and has no credit history whatsoever; .